A Comprehensive Guide to Business Personal Property Tax Filing: A Guide for Accountants

Business personal property (BPP) tax filings apply to assets like machinery, equipment, and furniture. Here’s everything you need to know about business personal property tax filings.

Business personal property (BPP) tax filings apply to assets like machinery, equipment, and furniture. Here’s everything you need to know about business personal property tax filings.

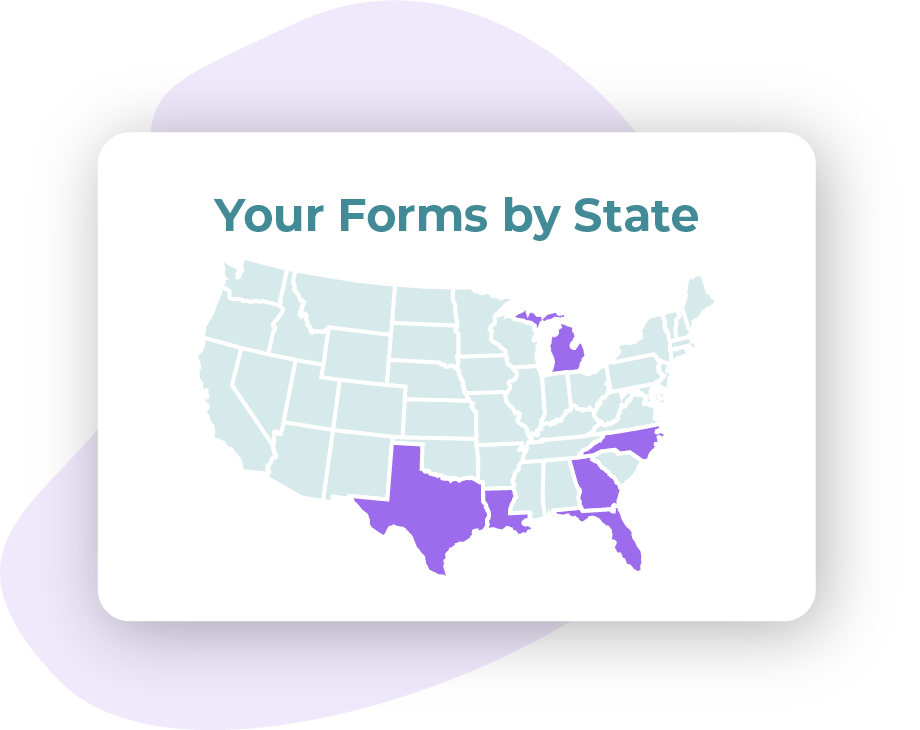

State-Specific Requirements Summary for BPP Tax Filing

Use this quick-reference guide to support your BPP tax filing in the following states:

North Carolina

- Form: AV-50

- Valuation Method: Cost approach

- Deadlines: January 31

- Penalties: 10% of assessed value for non-compliance

- Exemptions: Some local exemptions apply, including property used for educational or nonprofit purposes

Georgia

- Form: PT-50P

- Valuation Method: Market value

- Deadlines: April 1

- Penalties: 10% of taxes owed

- Exemptions: Small businesses may be eligible for the Freeport Exemption, which exempts certain types of inventory

Michigan

- Form: L-4175

- Valuation Method: Cost method

- Deadlines: February 20

- Penalties: 4% late penalty, 1% interest per month

- Exemptions: Personal property with True Cash Value (TCV) less than $180,000.

Florida

- Form: DR-405

- Valuation Method: Market value

- Deadlines: April 1

- Penalties: 5% per month late fee

- Exemptions: A $25,000 exemption is available for the first $25,000 of assessed value

Texas

- Form: No state standard (county-specific forms)

- Valuation Method: Cost approach

- Deadlines: April 15

- Penalties: 10% of the amount of tax due

- Exemptions: Various local exemptions favor agriculture and nonprofit-related property

Louisiana

- Form: LAT 5

- Valuation Method: Cost approach

- Deadlines: April 1

- Penalties: 15% penalty on assessed value

- Exemptions: Some industrial property may qualify for local exemptions

Valuation and Depreciation of Business Personal Property

States generally use one of three methods to value business personal property:

- Cost: Based on the original purchase price

- Market Value: What your client would pay for the asset in the open market

- Income Approach: Valuation based on the income the property generates

Make sure you use the correct valuation method when completing business personal property tax filings for your clients. Errors in depreciation calculations are common and can lead to over- or under-assessment of tax liability.

Exemptions and Special Provisions

Many states have exemptions and special provisions that could reduce your client’s tax liability. Here are the most notable provisions for each of the six jurisdictions featured above.

North Carolina: Exemption for Property Used for Educational or Non-Profit Purposes

Property used for nonprofit or educational purposes may be exempt from BPP taxes. The organization must provide documentation proving the property is exclusively used for exempt purposes.

Georgia: Freeport Exemption for Inventory

The Freeport Exemption applies to three classes of inventory:

- Raw materials and goods in the process of manufacture

- Finished goods produced in Georgia and held for shipment out of state

- Finished goods destined for shipment out of state and stored in Georgia

This exemption can be a huge benefit to manufacturers, wholesalers, and distributors.

Florida: $25,000 Exemption on Tangible Personal Property

Florida has one of the simplest exemptions. The first $25,000 of assessed value for tangible personal property is exempt from taxes. Simply file the DR-405 form before the April 1 deadline, and the exemption will automatically be applied.

Texas: Exemptions for Agriculture and Nonprofits

Texas exemptions are complex because each county has its own BPP form and provisions. However, many jurisdictions offer agricultural and nonprofit exemptions that can reduce your client’s liability. Familiarize yourself with the laws in your client’s home county and ensure you provide sufficient documentation when claiming any exemptions.

Louisiana: Special Provisions for Industrial Property

Louisiana’s Industrial Tax Exemption Program offers up to an 80% property tax abatement for up to 10 years on a manufacturer’s new investment. This program encourages businesses to invest in new manufacturing plants and equipment by providing a partial or full tax exemption on qualifying property.

Michigan: Personal property with TCV less than $180,000

Michigan allows businesses to exempt personal property if the total value of all assets in their possession is under $180,000 in true cash value. This provision primarily appeals to small business owners. Businesses with a TCV between 80,000 and 180,000 must file their Business Personal Property tax form annually in addition to their Small Business Property Tax Exemption form.

Deadlines and Penalties for Non-Compliance

Here’s a breakdown of the consequences of non-compliance for each state:

- North Carolina (January 31): Penalties equal 10% of assessed value for non-compliance

- Georgia (April 1): Penalties equal 10% of taxes owed

- Michigan (February 20): You will be charged a 4% late penalty and 1% interest per month

- Florida (April 1): Penalties are up to 5% per month on the balance owed

- Texas (April 15): Penalties vary by jurisdiction but are typically up to 10% of the amount of tax due

- Louisiana (April 1): 15% penalty on assessed value

Always review the latest tax laws and legislative changes to verify penalties and deadlines.

How to Avoid Common Filing Errors

Always double-check your calculations and ensure you are accounting for depreciation. Also, verify that you are using the right forms for the state in question.

Preparing for a BPP Tax Audit

Discrepancies between reported and actual values can trigger a BPP tax audit. Prepare for an audit by maintaining accurate records of all business personal property, including receipts and depreciation schedules.

Best Practices for Accountants Handling BPP Filings

Here are a few strategies to keep clients organized and compliant:

- Keep a digital archive of all records

- Use accounting software to automate parts of the filing process

- Review state-specific tax updates regularly

Following these practices ensures accuracy in filing.

Why Choose Taxscribe for BPP Form Filing?

Taxscribe simplifies the BPP tax filing process by offering:

- Centralized forms

- Efficiency

- User-friendly interface

- Support and resources

Take the hassle out of business personal property tax filings. Make life easier with Taxscribe.

Save Time on Business Personal Property Tax Filing

Accurate and timely BPP tax filings are essential for avoiding penalties and audits. Stay informed and organized to ensure your clients remain compliant. Tools like Taxscribe Pro make the filing process easier and more efficient.

Sign up for Taxscribe Pro and take advantage of your four free credits. You can spend 80% less time on your taxes with Taxscribe!